Patent portfolio management used to be an administrative discipline: tracking filing dates, paying maintenance fees, and maintaining records in spreadsheets or docketing systems. That foundation still matters, but it no longer supports the decisions in-house IP leaders are expected to make in 2026.

Today, executives expect IP teams to explain which patents protect revenue, which assets justify rising maintenance costs, where freedom-to-operate risk exists, and how the portfolio can support licensing, enforcement, or standards strategy. Answering those questions at scale is no longer possible with traditional tools alone.

This is why AI patent portfolio management software is becoming a core component of corporate IP operations. By combining machine learning, natural language processing, and continuous data integration, these platforms transform static patent lists into living sources of strategic intelligence—supporting valuation, pruning, risk mitigation, and monetization decisions with evidence rather than intuition.

This guide explains how AI patent portfolio management software works, why legacy portfolio workflows break down, and how modern portfolio intelligence supports real business decisions.

What is AI Patent Portfolio Management Software?

AI patent portfolio management software uses artificial intelligence to understand patent content at the claim level, connect patents to products, competitors, markets, and standards, and continuously recommend actions across the patent lifecycle.

Unlike traditional IP management systems—which primarily handle docketing, reminders, and document storage—AI-driven portfolio platforms are designed for analysis and decision support. They ingest global patent data, normalize ownership and families, analyze claim scope and prosecution signals, and enrich that data with external context such as competitor activity, scientific literature, product disclosures, and technical standards.

In practice, AI patent portfolio management software enables IP teams to:

- Consolidate and normalize global patent portfolios across jurisdictions

- Segment and cluster patents by technology, product, or business unit

- Score patents for value, risk, and strategic relevance using explainable criteria

- Support portfolio pruning and renewal decisions

- Accelerate freedom-to-operate (FTO) and invalidity triage

- Surface licensing, evidence-of-use, and standards-related opportunities

This shifts portfolio management from periodic reviews to continuous portfolio intelligence.

Why Traditional Patent Portfolio Management No Longer Scales

Most organizations can already answer how many patents they own. The harder—and more valuable—questions are which patents matter now and which no longer justify their cost.

As portfolios grow into the hundreds or thousands of assets, manual review becomes unscalable. Important signals remain hidden: patents that quietly block competitors, assets that could support licensing, or weak patents that continue to incur maintenance fees by default.

Cost pressure compounds the problem. Patent fee structures evolve, and filing and maintenance economics are not static. For example, the USPTO implemented updated patent fee rules effective January 19, 2025, reinforcing that portfolio economics require continuous reassessment rather than occasional review.

At the same time, innovation intensity remains high. The European Patent Office (EPO) continues to report strong filing volumes, particularly in AI-related technologies, highlighting the growing complexity and competitiveness of the patent landscape.

The core issue is not lack of data—it’s lack of insight. AI patent portfolio management software addresses this by continuously analyzing portfolios instead of relying on episodic, manual assessments.

A Decision-First Framework for AI Patent Portfolio Management Software

High-performing portfolio intelligence platforms are built around decisions, not dashboards. A practical operating model typically follows this repeatable loop:

- Consolidate and normalize the portfolio (families, assignees, legal status)

- Segment and cluster patents by technology and product reality

- Score value and risk using explainable, field-normalized criteria

- Map patents to products and competitor products

- Triage freedom-to-operate and invalidity risk early

- Identify monetization candidates (licensing, sale, spin-off)

- Document and execute portfolio decisions with audit trails

This framework aligns portfolio analysis with governance, budgeting, and executive reporting.

Portfolio Consolidation and Segmentation with AI Patent Portfolio Management Software

The foundation of effective portfolio intelligence is a clean, unified view of assets. AI patent portfolio management software automatically normalizes assignee names, consolidates patent families across jurisdictions, and reconciles legal-status discrepancies.

Once consolidated, the portfolio can be segmented in ways traditional tools struggle to support:

- Technology segmentation using CPC and IPC classifications

- Product-aligned segmentation based on internal taxonomies

- Geographic segmentation tied to commercialization and enforcement relevance

- Lifecycle segmentation by filing, grant, opposition, or expiration stage

More advanced platforms apply AI-based clustering to group patents by semantic similarity, revealing technology themes that cut across formal classifications. This allows IP teams to view portfolios the way R&D and product teams do—not just through legal codes.

Strategic Coverage and Moat Analysis

Counting patents is not the same as understanding competitive position. AI patent portfolio management software supports coverage and moat analysis by examining claim breadth, overlap, and adjacency across portfolios.

This enables IP teams to identify:

- Technology areas where the organization holds unique, defensible coverage

- Crowded zones with diminishing returns on incremental filings

- Whitespace opportunities aligned with R&D strategy

- Areas where competitors are building around existing claims

Macro-level patent activity rankings and trend analyses, such as those published by IFI CLAIMS, are often used by corporate teams to contextualize portfolio strength and competitor behavior.

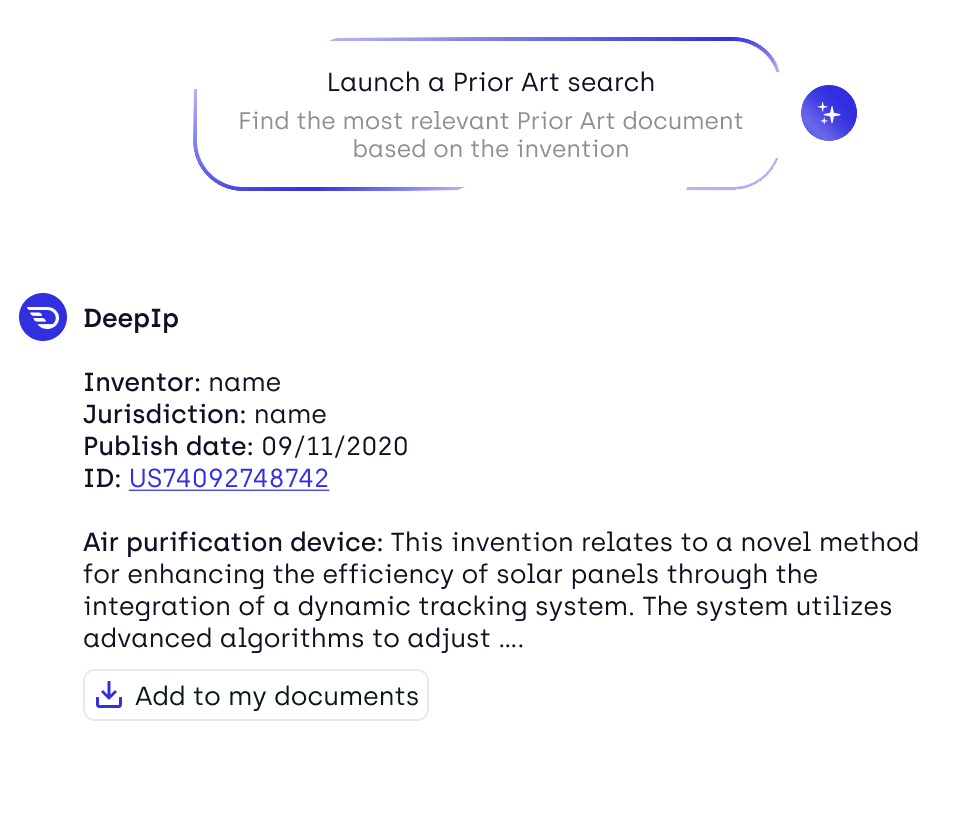

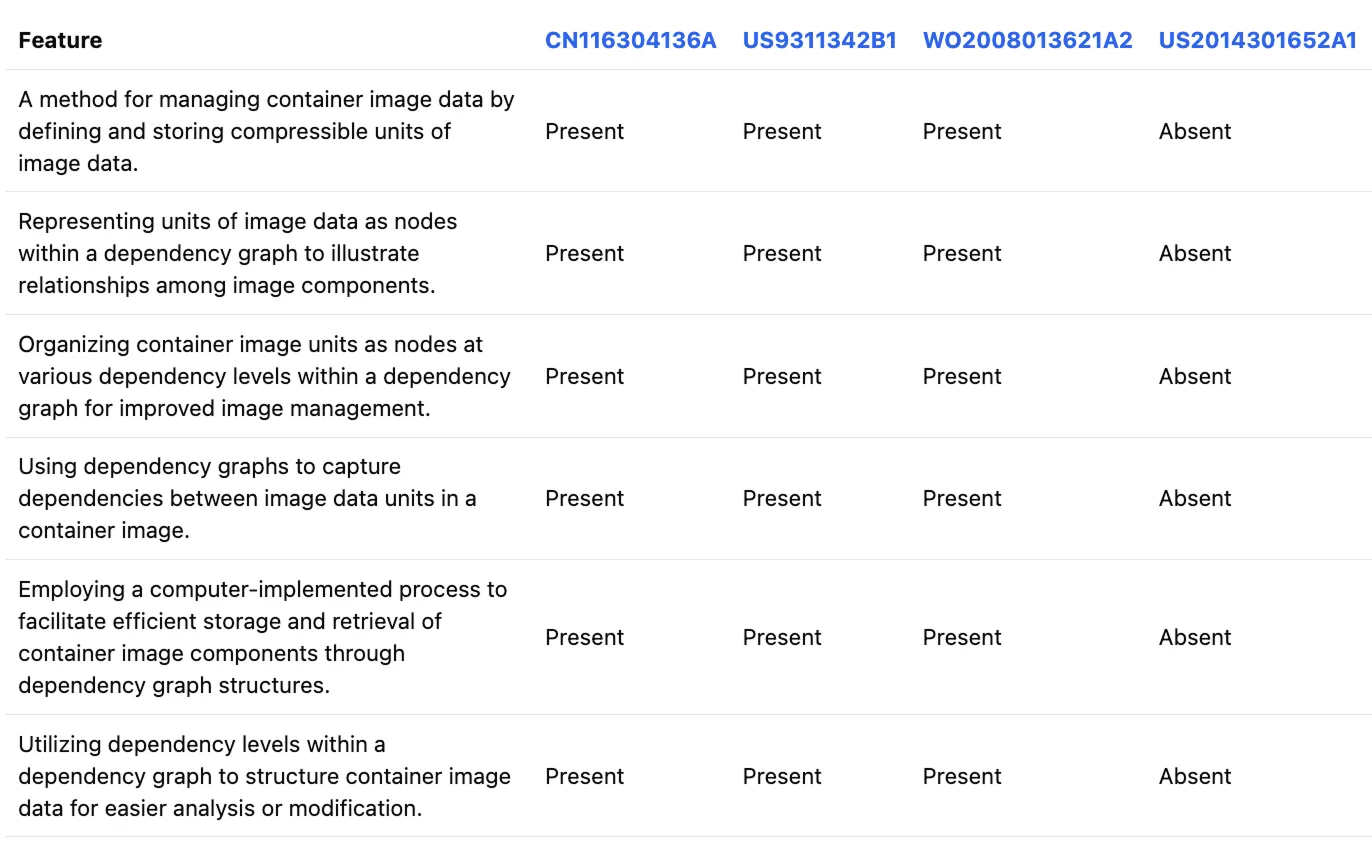

Freedom-to-Operate (FTO) Analysis at Scale

Freedom-to-operate (FTO) analysis is one of the most resource-intensive IP tasks. AI patent portfolio management software does not replace legal judgment, but it dramatically improves triage.

By mapping product features to patent claim elements and identifying overlaps with global patent data, AI platforms can:

- Generate preliminary claim charts with linked evidence

- Score infringement risk to prioritize attorney review

- Narrow large patent sets to the few assets that truly matter

This approach mirrors emerging industry tools for AI-assisted claim charting and infringement analysis, which emphasize evidence traceability and explainability.

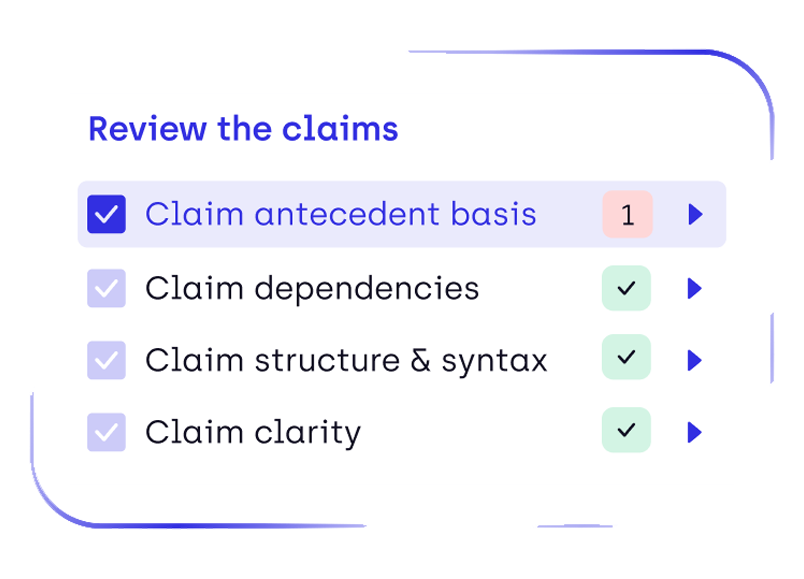

Invalidity Triage and Patent Quality Assessment

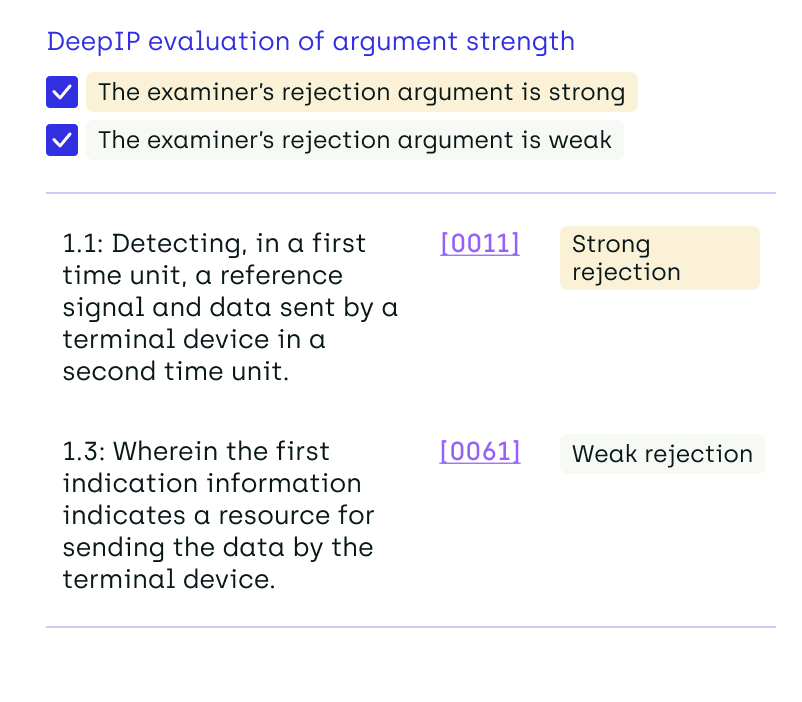

Invalidity search is often reactive—triggered by litigation or licensing conflict. AI patent portfolio management software enables earlier, continuous quality assessment.

By analyzing patent prosecution history and performing autonomous prior art searches, these platforms can surface:

- Claim amendments that signal narrowing or vulnerability

- Prior art the examiner may not have considered

- Patents with higher invalidity risk that merit closer review

This aligns with academic research exploring AI-driven frameworks for strategic portfolio pruning and quality assessment, which combine legal signals with market relevance.

Licensing, Evidence-of-Use (EOU), and Monetization Intelligence

One of the most strategic uses of AI patent portfolio management software is identifying external value creation opportunities.

By monitoring competitor products, technical disclosures, and public documentation, AI platforms can flag where third-party implementations appear to map onto patent claims. These evidence-of-use signals support licensing discussions and enforcement strategies with far greater efficiency than manual monitoring.

Industry analyses increasingly highlight the role of AI in transforming patent portfolios into active licensing assets rather than passive defensive tools.

Standards and SEP assessment with AI patent portfolio management software

In standards-driven industries, determining whether patents are standard-essential is notoriously complex. AI patent portfolio management software supports SEP assessment by semantically matching claim language to standards documentation and declared standards databases.

This capability supports both offensive and defensive strategies, particularly in FRAND-related licensing contexts. Industry commentary from patent analytics providers emphasizes how AI tools are increasingly used to support SEP licensing decisions.

Patent Valuation and Portfolio Pruning Decisions

Corporate patent valuation rarely requires a single dollar figure. Instead, it requires defensible prioritization.

AI patent portfolio management software supports pruning and budgeting decisions by scoring patents across explainable dimensions such as:

- Claim scope and validity risk

- Market and product relevance

- Enforceability and detectability

- Portfolio position and citation strength

This approach aligns with established patent valuation principles used in business and legal contexts, which emphasize legal strength and commercial relevance rather than abstract scoring alone.

What Corporate IP Teams Should Look for in AI Patent Portfolio Management Software

When evaluating platforms, high-performing IP teams typically require:

- Claim-level analysis, not keyword tagging

- Explainable scoring with linked evidence

- Family-level portfolio views and assignee normalization

- Product and competitor mapping for coverage and evidence-of-use

- FTO and invalidity triage outputs attorneys can audit

- Exportable work product for governance and outside-counsel collaboration

- Enterprise-grade security and data controls

These criteria separate true portfolio intelligence platforms from surface-level analytics tools.

Conclusion

The rise of AI patent portfolio management software reflects a broader shift in how intellectual property is governed. Portfolios are no longer static collections of rights—they are dynamic strategic assets that must be continuously evaluated, aligned, and defended.

By replacing episodic review with continuous portfolio intelligence, corporate IP teams gain the ability to control cost, reduce risk, uncover monetization opportunities, and justify patent investment decisions with evidence.

In 2026, the question is no longer whether AI belongs in portfolio management. It is whether organizations can afford to manage increasingly complex patent portfolios without it.

.png)